Key Insights 📈

- Expand Your Analytical Scope: Brands need to broaden their focus beyond vanity metrics in social listening to uncover deeper, strategic insights. Over-reliance on surface-level metrics limits the potential to extract meaningful information that could drive impactful decisions.

- Enhance Data Integration and Analysis: Integrate social listening data with other data sources like web analytics and financial KPIs for richer insights. This approach transforms social listening into a comprehensive tool for strategic decision-making, identifying trends and audience segments more effectively.

- Challenge the Status Quo: Current social listening practices, focused mainly on branded social media channels, need to evolve to embrace a wider range of data and analytical techniques. This change is essential to move beyond basic inbound marketing metrics and tap into a broader spectrum of strategic marketing insights.

- Address Key Operational Challenges: To maximize the value of social listening, brands must overcome challenges like budget constraints, limited leadership understanding, outsourcing analytical tasks, and technological misunderstandings. Tackling these issues is crucial for transitioning social listening from a tactical tool to a strategic resource.

- Implement Strategic Evolutionary Steps: Marketing leaders should apply strategic steps such as prioritizing high-impact business questions, leveraging analytical frameworks, and expanding beyond social media data. This strategic evolution enhances the role of social listening in informing marketing decisions and overall strategy.

The Lowdown on Social Listening Trends

Social listening has become a staple for marketing and public relations teams. Need to monitor campaign resonance? Analyze the latest trends? Benchmark your share of voice? Social data has your back. But here’s the million-dollar question—is your brand unleashing social listening’s full potential or just scratching the surface?

The 2023 State of Social Listening report suggests more gold to be mined. While social listening excels at marketing measurement, over-reliance on vanity metrics means strategic insights are being missed. With small but mighty tweaks, brands can evolve social data into a trusted advisor that reveals growth opportunities. This post explores those incremental enhancements that could give your brand a sustained competitive advantage.

Social listening involves monitoring and analyzing online conversations about a brand, competitors, industry, or topics on social media and other public platforms

For example, integrating social data with other information sources like web analytics, survey feedback, and financial KPIs opens new contextual insights. Layering predictive analytics and segmentation on top allows you to spot emerging trends and identify high-value audiences early. Improving workflow integrations with customer-facing teams promotes faster, more targeted responses to viral moments.

The Future of Social Listening Analysis

The future of social listening is unwritten—but those who embrace it now will shape it in their favor. Rather than maintaining a narrow focus on owned channels, expand monitoring to include earned, shared, and paid spaces across the broader social web. Look beyond surface-level metrics towards the strategic questions that drive growth, like improving audience targeting and campaign messaging. Supplement big data breadth with deeper qualitative dives on hot topics and influencer conversations. The insights are waiting below the surface.

Social data transitions from a rear-view mirror to a strategic compass with a fresh perspective and the right analytical enhancements. At its full potential, social listening spotlights unseen growth opportunities and charts a path toward them. The brands that will win tomorrow are the ones boldly mining deeper today.

Evolving Social Listening to Unlock Deeper Marketing Trends

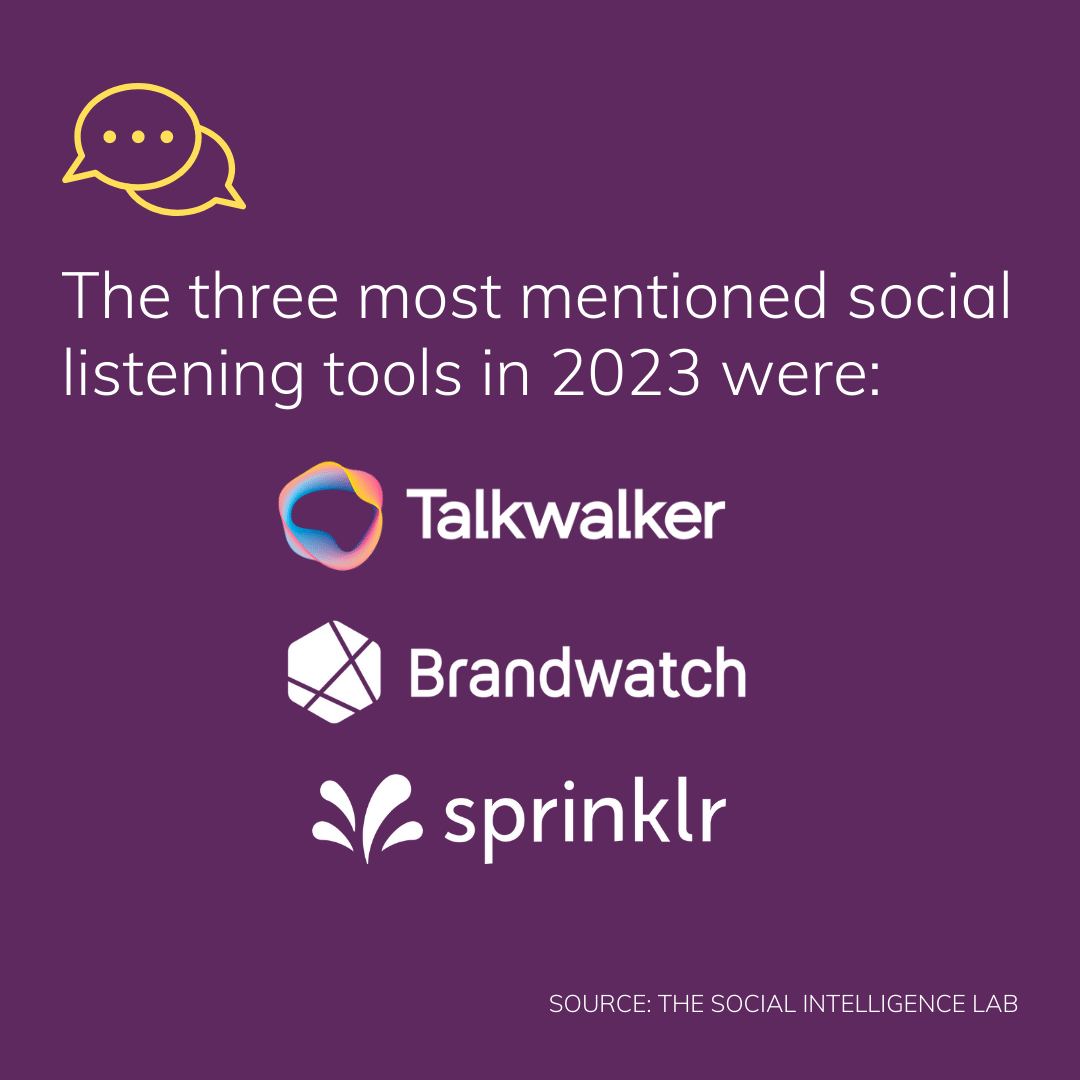

The 2023 State of Social Listening Report from The Social Intelligence Lab provides excellent insight into the current maturity of social listening across the marketing landscape. The comprehensive report aimed to evaluate how this evolving practice has developed and where there are still gaps.

The survey results show that marketing teams commonly use social listening for measurement purposes. It helps them track brand health metrics, analyze campaign performance, monitor competitors’ activities, and identify emerging consumer trends. Social media listening has firmly established itself as a helpful quantitative data source for marketers.

However, the social listening trends uncovered in the report highlight that there are still challenges like data access limitations and budget constraints. There also seems to be over-reliance on vanity metrics vs. deriving strategic insights to inform decisions. This suggests an opportunity exists to evolve social listening to drive more impactful, qualitative data-driven insights that can shape marketing strategy and planning.

This post explores how marketers can unlock more excellent value from their social listening insights to elevate their understanding of customers and markets. By addressing some of the current limitations highlighted in the report, social media listening has the potential to become an indispensable strategic resource rather than just a tactical monitoring tool.

For example, integrating social data with other information sources like web analytics, survey feedback, and financial KPIs opens new contextual insights. Enhancing analysis with predictive models and audience segmentation allows for spotting emerging trends and high-value groups earlier. Improving workflow integration with customer-facing teams also promotes faster, more targeted responses to viral moments.

Social data can transition from a rear-view mirror to a strategic compass with a fresh perspective, and the right analytical enhancements are integrated into the report’s social listening competitive analysis section. This evolution unlocks growth opportunities hidden below the surface metrics.

Current Role of Social Listening for Marketing Teams

The 2023 State of Social Listening Report shows that social media platforms dominate the primary data sources of current brand listening initiatives. Instagram, Twitter, Facebook, and TikTok were the top channels used by respondents for social media listening metrics. This indicates much social listening focuses squarely on monitoring owned, branded social media conversations.

In line with this narrow focus, the primary objectives for social listening analysis are understanding attitudes and opinions, brand health tracking, and competitive intelligence on social platforms. The everyday use cases are detecting trends, brand monitoring, campaign analysis, and competitive benchmarking — all within social media.

This all points to social listening being primarily leveraged for inbound marketing measurement activities. It provides valuable quantitative feedback on brand perception, campaign resonance, share of voice, and performance vs. competitors on social channels. Key strengths are real-time monitoring and vanity metrics from owned social media.

However, over-indexing on social media limits a broader perspective. The social media insights report showed reliance on set KPIs over applying strategic marketing frameworks for analysis. There is also heavy dependence on martech dashboards for self-serve metrics vs. human interpretation of the social listening data.

This suggests that in its current form, social listening fails to regularly generate deeper qualitative insights that can meaningfully inform marketing strategy and planning. There is a missed opportunity to evolve beyond the social listening statistics and towards unlocking context-aware insights from the wealth of data.

The path forward lies in embracing a broader, more proactive approach leveraging social listening’s full potential as an analysis tool. Rather than just monitoring owned media, expanding the scope to include earned, shared, and paid spaces across the social web is key. The brands that shape social listening’s next era will be those not limited by its current boundaries.

Challenges Limiting the Impact of Social Listening

The 2023 report highlighted several challenges that may be preventing social listening from unlocking more marketing value:

- Budget constraints were a top concern, especially for agencies supporting social listening initiatives. Securing adequate investment is critical to fully leveraging the potential of social data.

- Lack of leadership understanding – The report showed a decline in appreciation of social listening’s value. More education on ROI and clear use cases linked to marketing outcomes is needed.

- Outsourcing analytical tasks – Brands increasingly outsource social listening work to agencies, especially for ad hoc projects and dashboard creation. This misses the opportunity to make agencies more strategic insight partners.

- Confusion on the role of technology – Many expect technology to surface strategic insights from data automatically, but expert human analysis is still essential. This gap leads to disappointment.

- Data quality and access challenges – Desired sources like TikTok remain struggling due to API restrictions. This hinders a complete view of relevant conversations.

Addressing these challenges will be critical for social listening to evolve from a pure measurement function into a strategic marketing resource that can deeply inform planning.

5 Steps to Unleash Greater Marketing Value from Social Data

Based on the insights from the social listening report, here are some steps marketing leaders can take to drive more strategic value from social listening:

Table: Social Listening Strategies

| Strategies | Description | Benefits | Considerations |

|---|---|---|---|

| Prioritize high-impact business questions | Focus social listening on critical questions that will inform marketing decisions and strategy rather than vanity metrics. Take a hypothesis-driven approach. | Ties social data directly to strategic planning and decision making. Enables data-driven marketing strategy. | Requires cross-functional coordination between analysts and marketing leadership to align on right questions. |

| Apply analytical frameworks | Leverage frameworks like segmentation, journey mapping and jobs-to-be-done. Enriches context beyond social media statistics. | Connects social data directly to core branding, positioning and messaging decisions based on how target audiences think. | Analysts need fluency in applying analytical frameworks. Additional time and resources required. |

| Look beyond social media | Incorporate data from search, forums, reviews sites and other channels missing from social listening today. | Provides fuller context on broader conversations and brand perceptions. Reduces social media bias. | Significantly increases data and channel complexity. Requires platform expansion and access improvements. |

| Make agencies insight partners | Evolve agency relationships to focus on collaborating on strategy and extracting meaning from the data vs. just tactical reporting. | Drives more impactful, actionable insights tied to business objectives. | Requires asking agencies the right strategic questions and evaluating beyond cost/volume. |

| Educate leadership on potential | Demonstrate how deeper qualitative insights from social data can identify growth opportunities and influence planning. | Increases buy-in and investment in social analytics. Prioritizes evolving capabilities over maintaining status quo. | Takes time and resources to educate executives. Hard to demonstrate ROI of hypotheticals upfront. |

Prioritize high-impact business questions

The 2023 State of Social Listening Report shows that social media platforms currently dominate the primary data sources of brand listening initiatives. However, over-indexing on these owned spaces means missing the bigger picture context across the broader social web and owned channels.

Evolving social listening requires prioritizing high-impact business questions over tracking self-referential social media statistics. Rather than fixating on vanity metrics in a brand’s social listening dashboard, the focus should shift to addressing critical questions that empower strategic decision-making.

For example, how could improved audience targeting increase campaign effectiveness? What messaging resonates best with high-value customer segments? How do geographic and demographic variations impact brand perception? What emerging trends or market conditions should shape future positioning?

Addressing questions like these enables marketers to take a more hypothesis-driven approach to social listening analysis rather than just monitoring owned media at the surface level. Advanced analysis of broad social listening data should tie back and inform core branding, positioning, and go-to-market strategies.

Integrating additional data like CRM and financials enriches context while predictive modeling and sentiment analysis add depth missing from most social media insights reports today. Better workflow integration across marketing, product, and other customer-facing teams ensures insights achieve maximum business impact.

With the right analytical enhancements, social listening can evolve from a simple measurement tool into a strategic marketing compass guiding decisions. However it requires shifting priorities from vanity metrics towards the high-impact questions that will navigate brands to future growth opportunities. Tho

Apply Analytical Frameworks

The recent social listening trends uncovered in the report highlight an over-reliance on surface-level metrics versus applying analytical frameworks that can drive strategic insight. Simply monitoring owned social channels lacks fuller context.

By leveraging relevant frameworks from the social sciences, marketers can evolve social listening to unlock deeper insights from the data. Advanced segmentation provides a sharper perspective on high-value target audiences. Customer journey mapping spotlights key phases where brand perceptions shift. Jobs-to-be-done analysis reveals the underlying motivations driving consumer behavior.

Applying analytical lenses like these enriches the context missing from most social listening dashboards today. Rather than just tallying vanity metrics, it enables connecting data directly to core branding, positioning, and messaging strategy based on how audiences think and feel.

The report’s social listening competitive analysis section also highlighted the need to integrate additional datasets like web analytics, financial KPIs, and CRM data. This allows for richer, multi-dimensional analysis with the right conceptual frameworks.

With some fresh perspective and an analytical toolkit that goes beyond social media statistics, the full potential of social listening emerges. The raw data, cuando combined with strategic frameworks, spotlights unseen connections and growth opportunities hidden below the surface.

The brands that will write the next era of social intelligence are those stepping back from conventional wisdom to ask, “What deeper insights could shift our strategic direction?” The frameworks are there. The data is there. Evolving social listening requires focusing analytics on the right strategic questions.

Look Beyond Social Media Data

A key evolution required for brand listening is looking beyond social media listening metrics to understand the broader context around customer conversations. The current reliance on owned social channels provides a limited, self-referential perspective.

The social listening analysis should expand to incorporate data from forums, blogs, review sites, search trends, chat platforms, and more to enrich insights. What are customers saying about the brand on Reddit? How do forum views align with shifts in purchase consideration? How are influencer perspectives on YouTube shaping perceptions?

Incorporating these earned, shared, and owned channels provides a more well-rounded interpretation of market conversations than social listening dashboards offer today. It reduces biases from only analyzing first-party social data and fills critical blindspots.

Advanced natural language processing and sentiment analysis techniques allow mining this expansive data for strategic revelations about brand health, campaign resonance, emerging trends, and more. The insights unlock growth opportunities hidden outside social listening’s current boundaries.

Analyzing such a breadth of social listening data is more complex than just monitoring owned Facebook metrics. But for brands seeking a durable competitive edge, applying the latest analytical innovations to the full social sphere is necessary. The potential for rich, contextual social intelligence has outgrown social media’s limited borders.

Those still focused inward on owned social stats will be less prepared for market shifts in the broader sphere. But those embracing expanded inputs will shape social listening’s next era in their favor – where more listening culminates in better strategic decisions and smarter go-to-market plans.

Find a Social Media Listening Agency

Brands rely heavily on social media listening agencies, but most relationships remain tactical. Agencies deliver self-service social listening dashboards packed with statistics but often lack deeper strategic context. The missed opportunity lies in evolving agencies into true insight partners.

This requires shifting the focus from purely extracting social media listening metrics to collaborating on framing strategic questions that social data can address. Rather than dictating rigid social listening KPIs, brands should engage agencies in an ongoing dialogue on emerging business objectives and guiding decisions through analytics.

For example, how could improved audience segmentation improve target messaging to high-value customers? What new trends could significantly impact market share next year? Which segments appear ripe for tailored positioning campaigns? Guiding agencies in gathering the right social insights that inform strategies this way add tremendous value.

This model ultimately holds agencies accountable for extracting meaning from the data – not just conducting rote reporting on pre-determined metrics disconnected from strategic goals. More continuous collaboration between marketers and analysts takes better advantage of agencies’ analytics expertise while increasing business relevance.

The few brands pioneering this direction provide potential blueprints. Takeaways include focusing agency procurement and contracts on business impact, involving agencies early in strategic planning, and incentivizing actionable insights over volumes of tactical metrics.

Evolving social listening requires rethinking agency relationships. Those still relying on agencies as outsourced statisticians are missing out on making data a competitive advantage. But brands engaging agencies as strategic partners will own the future of social intelligence – where richer insights guide better decisions.

Educate Leadership on Potential

A key impediment to unlocking more strategic value from brand listening is the expectation gap between analysts immersed in the data and senior marketing stakeholders dependent on social insights to guide strategy. More education on the potential of social listening is required.

Today, many executives primarily expect social media listening metrics on campaign performance, share of voice, and brand sentiment – delivered through standard social listening dashboards. Going beyond surface-level statistics to generate deeper qualitative insights that shape decisions requires resetting assumptions.

Analysts must better demonstrate how applying the right analytical lenses and frameworks to broad social data can answer critical strategic questions around audience targeting, optimal positioning, and market trends. Rather than just monitoring lagging indicators, analysis can spotlight unseen problems and opportunities that influence planning.

This education shows leadership how to ask better questions that activate social insights instead of falling back on conventional operational metrics like engagement rates, follower growth, and lead counts divorced from financial outcomes. Deeper analysis has limited impact if leaders still cling to social media vanity metrics.

Effectively explaining how evolved social listening capabilities can identify unseen growth opportunities is key. With thoughtful framing and tangible use cases tied to strategic priorities, analysts can secure the buy-in required to apply their skills more impactfully through enhanced access, visibility, and trust – ultimately benefiting all sides.

It’s Time to Evolve Social Listening

As the 2023 State of Social Listening report demonstrated, social listening has firmly established its role in supporting marketing measurement. Monitoring branded social conversations in real-time and extracting performance metrics is invaluable.

However, over-reliance on social media data and vanity metrics means there is a missed opportunity to unleash even greater strategic value. With some incremental steps like prioritizing actionable business questions, incorporating new frameworks and data sources, and educating leadership, social listening has the potential to evolve.

The time is now for marketing leaders to tap into the full potential of social data. Taking a more strategic approach, social listening can offer indispensable qualitative insights that deeply inform planning and decision-making. Brands that embrace this evolution will gain a sustained competitive advantage.

The future of social listening is bright if marketed leaders are willing to address current limitations. It can transform from a tactical measurement tool into a trusted strategic advisor with thoughtful enhancements. The promise of social data is too great not to take this next step in its maturity.

FAQ

The top platforms were Instagram (51%), Twitter (49%), Facebook (44%), TikTok (31%), and LinkedIn (25%). This shows an over-reliance on major social media sites versus other forums.

The top objectives are understanding attitudes and opinions (57%), brand health tracking (55%), and competitive intelligence (40%). This indicates a focus on marketing measurement.

Trend detection (36%), brand monitoring (24%), campaign analysis (18%), and competitive benchmarking (18%) were most common. This further highlights the marketing measurement focus.

Data accuracy/quality (44%), budget constraints (41%), and compliance issues (26%) are the top challenges. Lack of leadership understanding of value (35% alignment) is also a barrier.

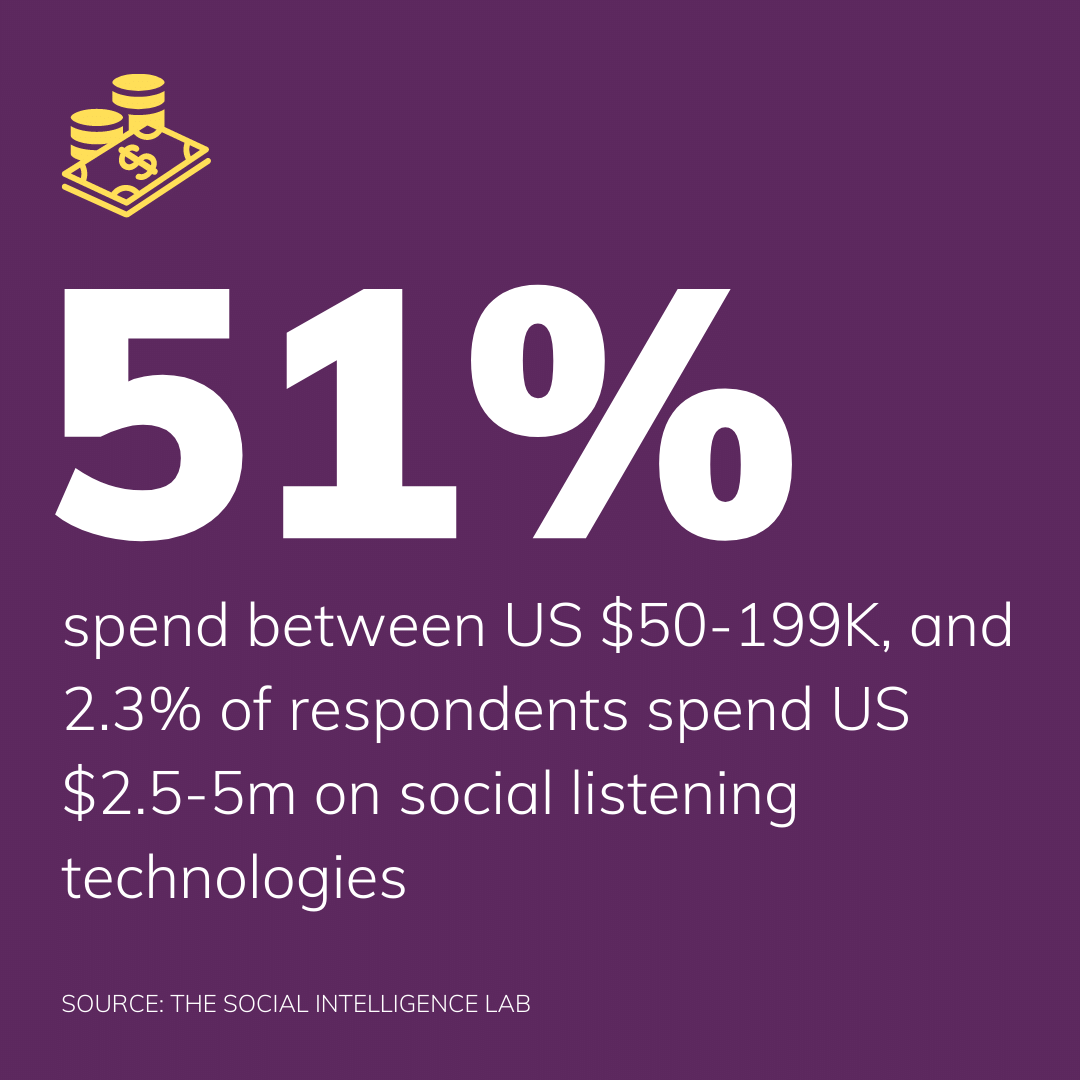

39% spend over $100K annually, with most spending $50K-$200K. 2% of enterprises spend $2.5-$5M showcasing heavy investment.

33% of brands spend $100K-$199K on agencies annually. Projects focus on ad-hoc analysis, dashboard creation, and deep consumer insights.

Data access/coverage gaps, analysis capabilities, and integration issues are top tech limitations hindering insight discovery.

51% take a question-driven approach to data sources. But 47% still use set KPIs versus applying analytical frameworks, showing dependence on metrics.