Critical Insights: Consumer Spending 💵

- Optimism Amidst Caution: Consumers foresee a brighter personal future. Despite this, there’s a tangible apprehension about the broader U.S. economic landscape, prompting more budget-conscious shopping habits.

- Hunt for Discounts: Economic uncertainty drives savvy shopping. The current climate has led to a surge in consumers seeking sales, discounts, and cash-back or rewards programs to stretch their dollars further.

- Shift in Spending Patterns: Spring 2023 will see varied spending. While there’s an anticipated rise in travel, beauty, and electronics expenditure, essentials like food and gas remain top priorities, especially for female decision-makers.

- Mobile Banking Dominance: Digital banking is the new norm. A staggering 72% of Prodege’s members embrace mobile banking apps, with Gen Z and Millennials leading the charge due to their convenience and flexibility.

- Inflation’s Grip: Rising costs influence consumer choices. The escalating prices of essential items and increased rent and utility expenses significantly shape consumer purchase decisions.

- Financial Confidence: Personal financial goals remain unshaken. Even with low confidence in the U.S. economy, consumers strongly believe in achieving their financial aspirations, from retirement planning to emergency savings.

Understanding consumer spending trends is crucial for businesses looking to thrive in our fast-paced economy. As consumers continually shift their preferences and priorities, companies must adapt quickly or risk becoming obsolete. The winds of change blow swiftly in the marketplace, and no business can afford to sail blindly ahead without scanning the horizons. Savvy companies monitor emerging consumer behaviors, allowing them to set their course toward growth and profits. Whether it’s the latest tech gadgets, food fads, or fashion styles, tomorrow’s winners will spot those trends early and ride the wave.

Other businesses may sink, weighed down by nostalgia and failure to read the signs of the times. But those who study consumers, understand their desires, and align their strategies accordingly will cruise smoothly into the future.

Consumer Spending Trends

Understanding consumer spending trends is critical for brands to stay competitive in today’s economic landscape. A report from Prodege, “2023 Consumer Spending Attitudes: Smooth Sailing or Proceeding with Caution?” provides an in-depth analysis of these trends, offering valuable insights into the mindset of US consumers. The report explores various topics, from consumer searches for sales and discounts to shifts in spending and confidence in financial goals.

The report reveals a complex picture of consumers. On one hand, there’s an optimistic outlook on personal lifestyle, with many expecting their situation to improve in the next 12 months. On the other hand, there’s a level of caution and concern about the overall state of the U.S. economy, leading to more budget-conscious shopping habits.

This dichotomy is further explored in the report, examining anticipated changes in spending habits, the role of mobile banking, and the impact of inflation on consumer purchase decisions. The insights provided in this report are invaluable for brands, retailers, and marketers aiming to understand their customers better and win their business in these uncertain times.

Exploring Consumer Behavior Towards Sales and Discounts

In an uncertain economic climate, American consumers display a blend of optimism and caution. While most are content with their current lifestyle and foresee improvements in the coming year, there’s a tangible sense of apprehension about the overall state of the U.S. economy. This has led to an increased search for sales, discounts, and deals through cash-back or rewards programs to manage their budgets.

Changes in Consumer Spending Patterns

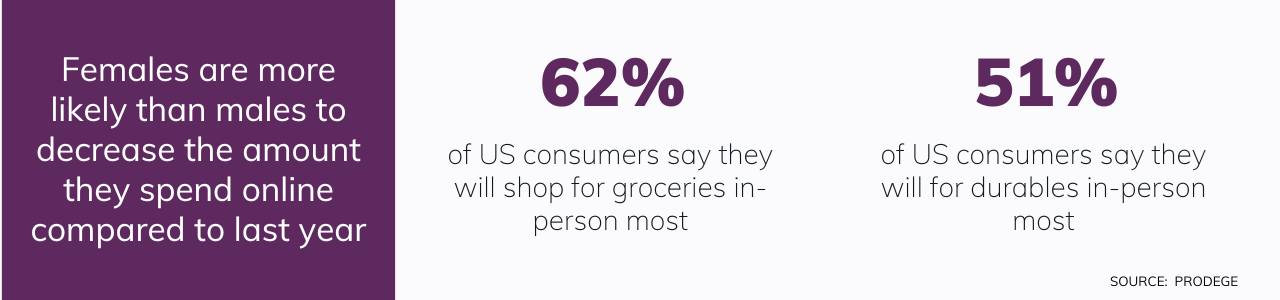

The report indicates that Americans plan to adjust their spending habits compared to the previous year. As of Spring 2023, spending on travel, clothing, beauty, electronics, and dining out is expected to increase. However, essentials like food and gas are likely to be prioritized more by females, who are often the primary decision-makers. In contrast, males are expected to invest in items with longevity.

Consumers Focused on Achieving Financial Goals

| Key Point | Details |

|---|---|

| Confidence in Financial Goals | Despite the low confidence in the U.S. economy, consumers remain highly confident about achieving their personal financial goals. |

| Financial Goals | These goals span various areas, including retirement planning, emergency savings, and budgeting. |

| Consistency Across Demographics | These financial aspirations are consistent across different age groups and income levels. |

| Role of Mobile Banking | Mobile banking is a prevalent tool among consumers, especially Gen Z and Millennials. It offers convenience and flexibility in managing finances. |

| Impact of Inflation on Purchase Decisions | Inflation influences consumer decisions by increasing the cost of essential items and expenses such as rent and utilities. This rise in costs is shaping consumer behavior and their purchasing choices. |

High Confidence in Achieving Personal Financial Goals

Despite low confidence in the U.S. economy, consumers are highly confident about achieving their financial goals. These goals, which include retirement planning, emergency savings, and budgeting, are consistent across different age groups and income levels. Mobile banking, prevalent among Gen Z and Millennials, is a convenient and flexible financial management tool.

Consumer Plans for Discretionary Spending

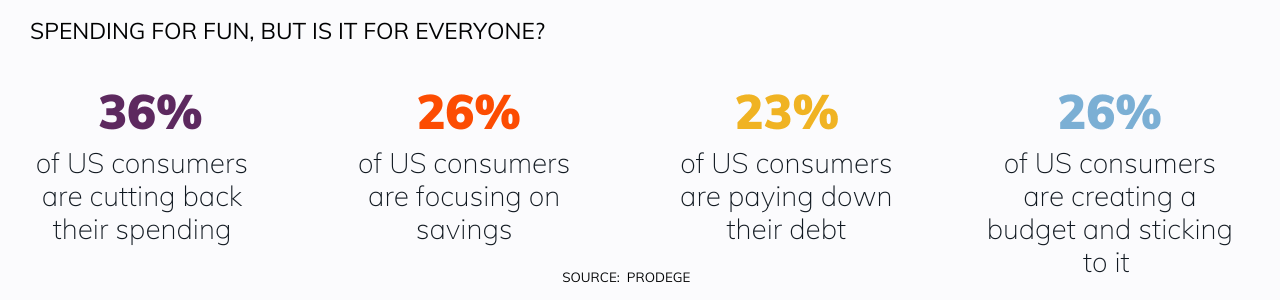

When it comes to discretionary spending, many Americans are exercising caution. The report notes a decline in the prioritization of contributions to savings accounts from January to March 2023. Interestingly, Gen Z and Millennials focus more on budgeting and savings than older generations.

Financial Goals and Concerns Among Consumers

The report outlines the top financial goals and concerns among consumers. Saving money, paying bills, and staying within budget emerge as critical goals. On the other hand, concerns revolve around having sufficient emergency savings, covering monthly bills, and affording food and other essentials.

The Role of Mobile Banking and Shifts in Spending

Mobile banking apps are gaining popularity, with 72% of Prodege’s members acknowledging their use. The benefits of these apps, including ease of use, 24/7 access, faster banking, and flexibility, are driving their popularity, particularly among Gen Z and Millennials. The report also discusses anticipated changes in consumer spending in various categories compared to the start of 2023.

See here for more Gen Z trends and insights.

The Impact of Inflation on Consumer Purchase Decisions

The report’s final section investigates how inflation affects consumer purchase decisions. It highlights the increasing cost of essential items and expenses such as rent and utilities and how these factors influence consumer behavior.

McKinsey Report: Consumer Spending Habits

According to this report from McKinsey, the COVID-19 pandemic triggered seismic shifts in consumer behavior and spending patterns. As the US emerges from the crisis, people adopt a hybrid of new normals and pre-pandemic habits. Consumers are spending robustly despite inflation, aided by excess savings. Yet rising prices drive changes like brand switching and channel preferences in search of value. Omnichannel shopping is now standard, with integrated online and offline experiences critical.

Interesting divergences are also evident demographically, as younger consumers prioritize social impact in buying decisions much more than older shoppers. For brands and retailers, an astute understanding of these evolving consumer traits will be key to gaining market share amidst a nuanced post-pandemic retail landscape. Agile strategies harnessing data-driven insights can help identify and serve emerging needs.

I apologize for the oversight. Here’s the updated table with all the subheads from the “McKinsey Report: Consumer Spending Habits” section:

| Key Point | Details |

|---|---|

| Pandemic’s Impact on Consumer Behavior | The COVID-19 pandemic triggered significant shifts in consumer behavior and spending patterns. As the US emerges from the crisis, consumers adopt a mix of new normals and pre-pandemic habits. |

| Consumer Spending Amidst Inflation | Consumers are spending robustly despite inflation, aided by excess savings. Yet rising prices drive changes like brand switching and channel preferences in search of value. |

| Omnichannel Shopping | Omnichannel shopping is now standard, with integrated online and offline experiences being critical. |

| US Consumers Exhibit New and Old Behaviors Post-Pandemic | Consumers are adopting a blend of pre-COVID and new behaviors. E-commerce has risen, but traditional retail is also rebounding. |

| Spending Patterns Reveal Increased Consumer Spending Despite Inflation | US consumers have continued spending robustly despite inflation. They have excess savings from the pandemic, but rising prices also increase credit card balances. |

| Inflation Drives Down Volume Growth in Certain Categories | Inflation impacts volume growth in sectors like gasoline, restaurants, and travel. However, inflation only accounts for a minor portion of growth. |

| Consumer Confidence Declines in Early 2022 | Consumer confidence dropped in February 2022, with only 38% of consumers expressing optimism. |

| Brand Loyalty Shifts Accelerate in Search of Value | 2022 saw a rise in consumers switching between brands and retailers, primarily driven by the search for better value due to rising prices. |

| Online and Offline Retail Both See Sales Growth | E-commerce has maintained growth, but brick-and-mortar retail is also rebounding. An integrated omni-channel approach is essential. |

| Omnichannel Shopping Becomes the Norm | 73% of US consumers report regularly researching and making online and in-store purchases. |

| Home Improvement Spending Continues Amidst Nesting Trend | Home improvement spending remains elevated, with consumers continuing to invest in home upgrades and comfort. |

| Younger Consumers Prioritize ESG Factors | Younger demographics prioritize brand transparency, ethical conduct, and social impact when purchasing. |

US Consumers Exhibit New and Old Behaviors Post-Pandemic

Consumers are adopting a blend of pre-COVID and new behaviors as the US emerges from the pandemic. E-commerce has seen steady rises, with online shopping becoming habitual for many. However, this hasn’t fully displaced traditional retail, as brick-and-mortar store sales are rebounding as consumers return to physical shopping. This highlights the need for an integrated omni-channel approach. Consumers are also spending more time outdoors dining, traveling, and socializing. Yet nesting trends persist, with continued investments in home upgrades and comfort. Notably, consumers are more willing to switch between brands, enticed by better prices, deals, and novel options amid high inflation.

Spending Patterns Reveal Increased Consumer Spending Despite Inflation

Despite experiencing record-high inflation in early 2022, US consumers have continued spending at robust rates. In March 2022, household spending was 18% higher than two years prior. This resilience has been powered largely by the excess savings cushion accumulated by consumers during the pandemic, totaling over $2.8 trillion above pre-pandemic levels. However, rising prices also increase credit card balances as consumers take on debt to maintain their lifestyles. This indicates that while overall spending has surged, it may be shaky.

Inflation Drives Down Volume Growth in Certain Categories

For some spending categories, increased dollars are primarily driven by inflationary pressure. Sectors like gasoline, restaurants, and travel have seen consumer volume decrease, masked by higher prices. But for other categories like retail goods, inflation only accounts for a minor portion of growth, with volumes also rising steadily. Granular data is necessary to understand true consumer demand. While spending is up in aggregate, rising prices create divergence across sectors.

Consumer Confidence Declines in Early 2022

After progressively gaining ground through 2021, US consumer confidence experienced a concerning drop in February 2022. Only 38% of consumers expressed optimism about their finances in the latest survey period, a significant decline from 44% in October 2021. This fall in confidence was most pronounced among higher-income households. With macroeconomic uncertainty around interest rates and geopolitical tensions, consumers are growing more cautious in their outlook. If persists, this pessimism could eventually dampen discretionary spending.

Brand Loyalty Shifts Accelerate in Search of Value

2022 saw a sharp rise in consumers switching between brands and retailers compared to any other period since the pandemic onset. The primary factor driving this disloyalty is the search for better value and deals as prices surge across categories. Nearly 90% of US consumers noticed price hikes on frequently purchased products like gas, groceries, and everyday essentials. To cope, they are actively shopping around, buying larger pack sizes, substituting with cheaper brands or private labels, and trading down where possible. This creates opportunities for value-oriented brands.

Online and Offline Retail Both See Sales Growth

E-commerce has maintained strong, consistent growth during the pandemic, with online sales up 27% year-over-year in March 2022. However, brick-and-mortar retail is also rebounding as consumers return to physical stores, evident in the 8% annual sales growth for in-store purchases in March 2022. This highlights that digital and traditional channels remain relevant, and integration between the two experiences is paramount. Retailers need advanced omnichannel strategies to satisfy consumers who seamlessly switch between online and offline shopping modes.

Omnichannel Shopping Becomes the Norm

Omnichannel retail is becoming standard, with 73% of US consumers reporting regularly researching and making online and in-store purchases. 45% also say social media platforms influence buying decisions, especially for product categories like cosmetics, footwear, and sports apparel. Younger demographics are particularly receptive. Retailers need a presence across touchpoints where consumers engage, providing consistent experiences online, in-store, on social media, and beyond. Integrated data utilization also enables better personalization.

Home Improvement Spending Continues Amidst Nesting Trend

Home improvement and furnishings spending remain elevated despite increased outdoor recreation and travel. In early 2022, home improvement expenditures were 11% above what pre-pandemic forecasts projected after accounting for inflation. This nesting mindset has persisted thanks to remote work flexibility, as consumers invest in home offices, backyards, and overall comfort. DIY and decor projects provide enjoyment and mental health benefits as well. Brands catering to home activities and upgrades are likely to see ongoing demand.

Younger Consumers Prioritize ESG Factors

Younger demographics like Millennials and Gen Z emphasize brand transparency, ethical conduct, diversity, and social impact when purchasing compared to older consumers. They favor companies that care for employees, support communities, and address societal issues with authenticity. However, older shoppers focus more heavily on health, safety, and environmental factors in brand selection. Understanding these variances allows smarter messaging and positioning.

Wrapping up Consumer Spending Trends

In conclusion, the Consumer Spending Attitudes report provides valuable insights into the current consumer spending trends. Despite economic uncertainties, consumers are optimistic about their financial goals and are making strategic adjustments to their spending habits. Brands and retailers can leverage these insights to understand their customers better and tailor their offerings accordingly.

As the economic landscape continues to evolve, staying abreast of these trends will be crucial for brands to remain competitive and relevant. The data in this report can help companies navigate the complex consumer landscape, helping them to make informed decisions and strategies.

FAQ

Consumer spending patterns are showing an increase in certain areas. As of Spring 2023, there’s an expected rise in spending on travel, clothing, beauty, electronics, and dining out.

In 2023, consumers display a blend of optimism and caution. While many anticipate improvements in their lifestyle, there’s also a heightened search for sales, discounts, and deals. Spending on travel, clothing, beauty, electronics, and dining out is expected to increase, but essentials like food and gas remain top priorities.

While there’s optimism about personal financial situations, there’s a level of caution and concern about the overall state of the U.S. economy. This has led to more budget-conscious shopping habits, indicating a more cautious approach to spending.

Consumer spending is showing a dichotomy. On one hand, there’s an optimistic outlook on personal lifestyle improvements. Still, on the other, there’s caution due to concerns about the U.S. economy, leading to a more measured spending approach.

Consumers are exercising caution in their discretionary spending. There’s a noted decline in prioritizing contributions to savings accounts from January to March 2023, and many are seeking sales, discounts, and deals to manage their budgets.

There’s a tangible sense of apprehension about the overall state of the U.S. economy. This concern leads to increased searches for sales, discounts, and deals and a more budget-conscious approach to shopping.

Mobile banking is becoming increasingly popular, with 72% of Prodege’s members using mobile banking apps. These apps offer ease of use, 24/7 access, faster banking, and flexibility, making them especially popular among Gen Z and Millennials.

Inflation impacts consumer decisions by increasing the cost of essential items and expenses such as rent and utilities. This rise in costs is influencing consumer behavior and their purchasing choices.

The top financial goals for consumers include saving money, paying bills, and staying within budget. In contrast, the primary concerns revolve around having sufficient emergency savings, covering monthly bills, and affording food and other essentials.