There are many reasons why multi-channel PR intelligence crushes all PR analytics, especially metrics like share of voice. It requires targeted and specific segmentation of all media channels and an in-depth look at how the media covers your business. It takes time and effort, but the results are worth it.

Ok, back today talking about multi-channel media intelligence — not to be confused with general PR metrics, typically just counting media mentions.

What is PR intelligence?

PR intelligence is about dissecting the entire media ecosystem and all its parts to uncover actionable and defendable insights that you can use to make decisions. Audience research in the form of media will help you understand the following:

- Get coverage in high-impact media publications that don’t cover you

- Understand why high-impact media publications are writing about your competitors

- How your narrative is being perceived by one media outlet against others

- Identify white space in the market in case you need to pivot your narrative or change your media engagement strategy

These are just a few things you can learn from PR intelligence. There are hundreds of other insights and many ways to slice and dice your data. For example, most PR measurement dashboards look solely at impressions and hits.

So let’s take a look.

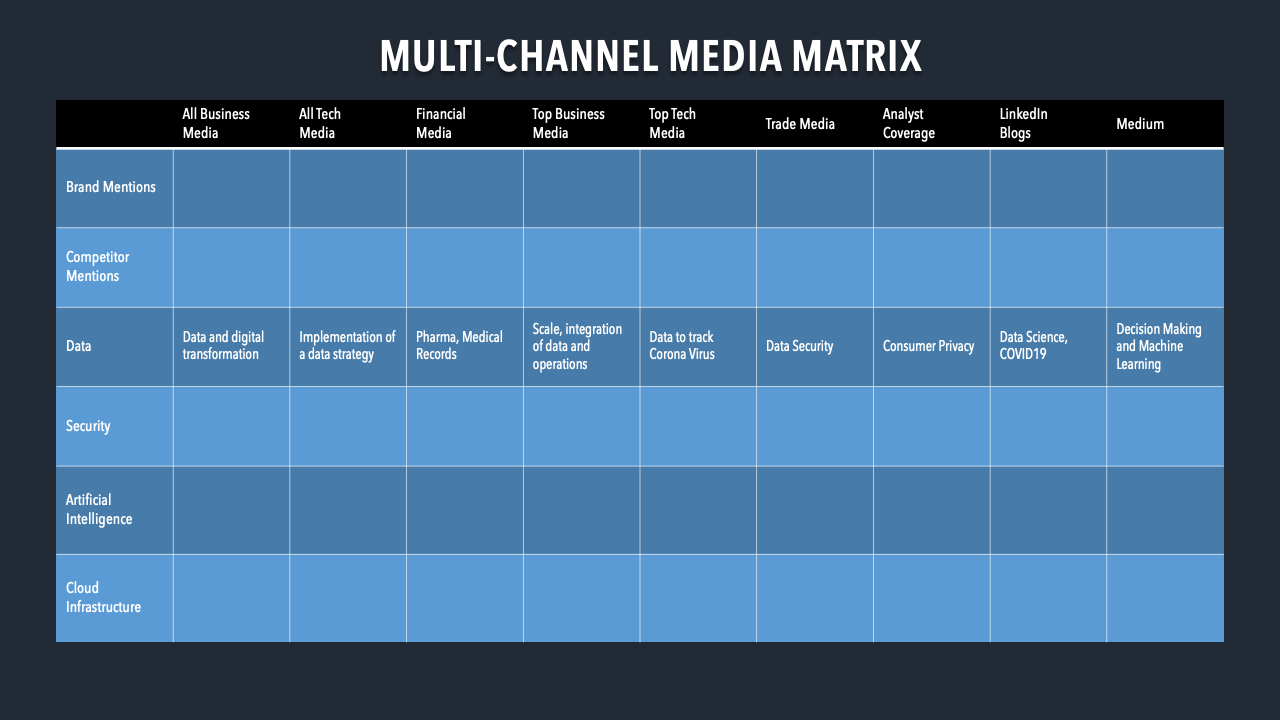

So I call this a multi-channel PR intelligence matrix, broken down like this.

On the left, you’ll see the brand and competitive mentions. These metrics will change based on your priorities and business goals. Also, depending on your business line, you’ll want to track specific topics that describe the market and the problems you are trying to solve.

Along the top row, you have specific media channels segmented by different media types. This type of segmentation is where you can start to see unique insights into coverage.

All business media is pretty self-explanatory. This is Forbes, Business Insider, Bloomberg, and The Wall Street Journal. All tech media are outlets like The Verge, TechCrunch, VentureBeat, Gizmodo, and ReadWrite.

It is not going to get into financial media. Not because it’s not essential but because it’s just something I am not interested in. It’s boring to me.

Ok, here is where we start getting a little more focused.

The top business media isn’t necessarily the same as all business media. There’s undoubtedly overlap, but the leading business media are the highest priority media publications you care about- maybe it’s your top 10 or 25 media outlets.

This is the exact definition of the top tech media.

If you are a security company, trade media are publications like Dark Reading, ThreatPost, and Security Week.

Analyst coverage isn’t really what you think it is. Well, it is, but it’s more.

Certainly, if you are a software company with some cash, the Magic Quadrant is something you’ll want to include because it’ll garner coverage for days.

But there’s more. Most analyst firms also publish long-form content weekly and, in some cases, daily. While they may not mention you specifically, I guarantee they are talking and writing about topics you want to pay attention to.

LinkedIn blogs. Huge. Thousands of blog posts are written on the platform daily about any business topic you can think about. Same for Medium. Last I looked, they get about 100M unique visitors per month. And the content isn’t just technology and business.

Fashion, sports, healthcare, and food dominate Medium headlines.

So the next natural question is, “Why would you spend so much time and resources on PR measurement and share of coverage for each of these individual channels?” So we’ll first — I won’t tell you to measure the share of voice.

I take that back, it might be one data point on a slide somewhere, but I will tell you to analyze the context and narratives of each media channel because I can guarantee you this: the business media covers your business is different than the way tech media will.

And when you decrease the data set from “All Business Media” to “Top Business Media” or go from 300 media publications to just 10 or 25, your mind will be blown by how each channel contextualizes your brand, competitors, and even the topics.

Now I have topics here because you need to spend more time understanding how to align your narrative to what’s relevant to the media.

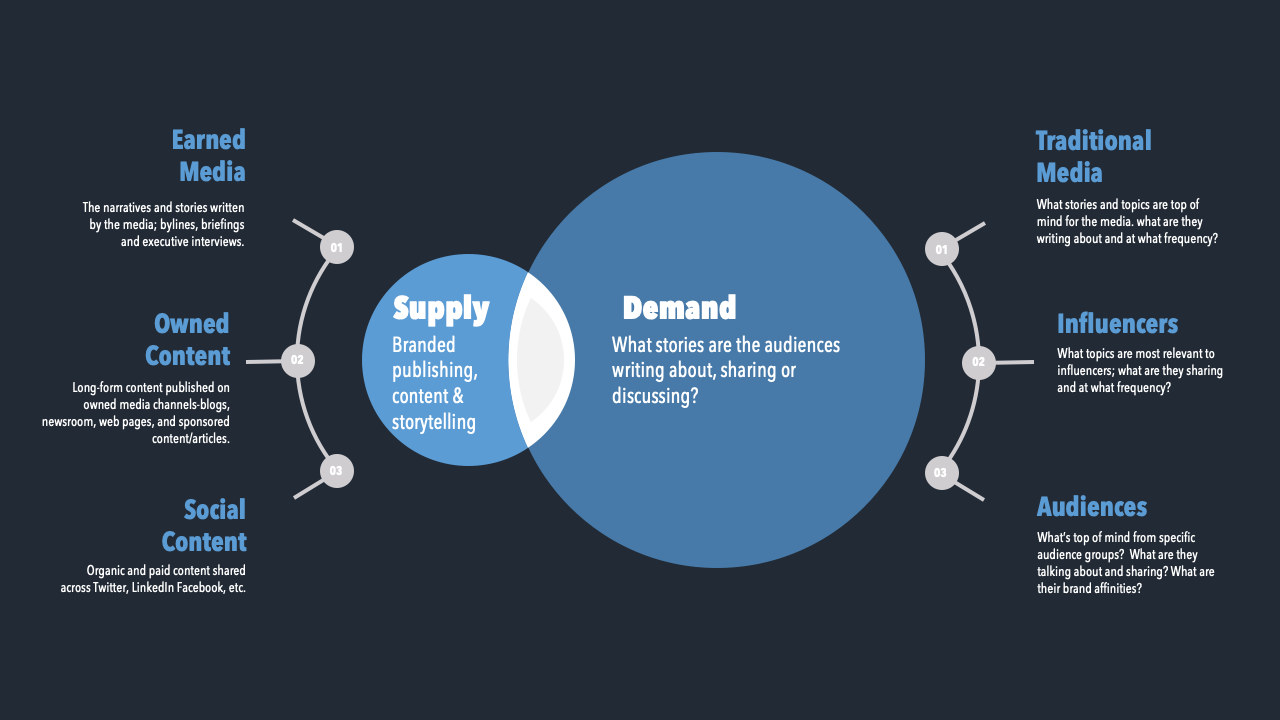

The below model shows the supply and demand of audience relevance — which is about understanding what stories and topics are demanding the attention of your audience (in this case, the media.) You then have to ask yourself if the content you are supplying to the market is meeting the demand of your audience.

You can only get this type of data from multi-channel PR intelligence. But, again, this is not media monitoring or even social listening.

This is where you find white space because, at the topic level, you can uncover unique insights when you segment the media, mine their coverage, cluster it into subtopics, and then contextualize the results.

Here’s a quick example:

I did a cursory data scan and cross-referenced each of these specific media channels. And as you can see, the way each segmented media channel covers data is different.

The business media is talking about using data to drive digital transformation. The tech media covers the implementation of company-wide data strategies. The financial press covers data in Pharma and medical records.

The top business media is getting more specific and talking about how business is scaling data operations successfully and integrating into the rest of the organization.

The top tech media is covering companies using data to track the coronavirus and using AI to predict new cases.

Trade media covers data security naturally. Consumer privacy and data protection are top of mind for analysts. On LinkedIn, it’s all about data science and COVID-19.

And lastly, on Medium, the conversation revolves around decision-making and machine learning.

As you can see, when you segment this media and contextualize the coverage at that level, you can glean particular and actionable insights that you can use to make smarter decisions.

Oh, and yes, you can measure the digital share of voice at each of these channels. It would be pretty interesting to see the variance in coverage between each.

And this is why multi-channel PR intelligence crushes all public relations measurement.

Related Content