Consumer intelligence has become a key differentiator in business, empowering brands with actionable insights to win.

Why this matters:

Leveraging AI-enabled consumer intelligence enables brands to stay ahead of market trends and reach their audience with marketing initiatives that make an impact.

By the numbers:

- Consumer intelligence-driven marketing can increase ROI by up to 30% (Forrester)

- 89% of marketers believe that understanding customer preferences is crucial for delivering a personalized experience (Salesforce)

- Brands that prioritize customer intelligence are 2.1 times more likely to outperform their competitors in terms of revenue growth (Gartner)

At the heart of every successful brand lies a deep understanding of its customers, achieved through the power of consumer intelligence. This essential tool captures the essence of customer insights, fueling the growth of companies and PR pros alike. Harnessing the potential of consumer intelligence is a journey that begins with defining it and diving into its varied types and use cases.

Defining Consumer Intelligence and Its Impact on Marketing

Consumer intelligence involves interrogating customer data about specific audiences. By harnessing this knowledge, marketers can gain invaluable insights into the distinct consumer groups, their preferences, shopping habits, consumption patterns, and the attributes they seek in the brands they like or dislike. In essence, consumer intelligence serves as an ongoing series of focus groups.

There are several use cases and applications of AI-enabled consumer intelligence. Product development is an area where these insights prove invaluable. Companies can design products that cater to their audience’s desires by understanding customer needs and preferences. Similarly, consumer intelligence is crucial in crafting targeted marketing campaigns, ensuring that promotional efforts elicit an emotional response from potential customers.

Consumer intelligence is not a one-size-fits-all concept. Instead, the use cases vary depending on a brand’s goals and priorities. For example, demographic data sheds light on customers’ age, income, and location, while psychographic data delves deeper into their personalities, values, and lifestyles. These two data types form a comprehensive picture of the target audience, enabling brands to create personalized customer experiences.

Another layer of consumer intelligence is behavioral data, which focuses on customer and brand interactions. This includes purchase history, website visits, and customer service inquiries.

Exploring Consumer Intelligence Methodologies

The landscape of consumer intelligence is vast, encompassing various methodologies, each with unique strengths and limitations. However, companies can make informed choices to serve their customers better by understanding the core differences between primary research, social analytics, and quantitative and qualitative analysis.

At the heart of consumer intelligence lies primary research, which allows brands to collect firsthand information straight from the source. This approach empowers companies to understand consumer preferences, motivations, and behaviors, fostering a genuine understanding of their audience. However, primary research is not without its challenges. Time and financial constraints can hinder the process, as designing and implementing surveys or conducting interviews require substantial resources.

On the other hand, social analytics opens the door to the digital ecosystem, where online platforms such as social media channels and forums offer a glimpse into consumer sentiment and trends. Moreover, this powerful method boasts real-time insights, enabling companies to adapt swiftly to emerging trends and adjust their strategies accordingly. Yet, the surface-level nature of social analytics might not reveal the depth of understanding that primary research can provide, as it often focuses on the visible aspects of consumer behavior.

Measurable data drives quantitative analysis, including sales figures, web traffic, and customer demographics. It offers precise and objective information that can effectively evaluate the success of marketing campaigns or predict future trends. However, the complexities and subtleties of human behavior might remain obscured by this method, as it may not be able to capture the essence of the human experience.

In contrast, qualitative analysis delves into the intricate aspects of consumer behavior and preferences through focus groups, in-depth interviews, and observation. This approach seeks to uncover the underlying reasons and motivations driving consumer choices, resonating with the audience on an emotional level. However, its smaller sample sizes can make it challenging to generalize findings to the larger population.

In the quest to understand consumer behavior, companies face a myriad of opinions and counter-arguments surrounding the efficacy of different types of consumer intelligence. For example, some critics argue that an overreliance on quantitative data can result in superficial understanding. In contrast, others caution against overemphasizing qualitative data that may lead to anecdotal evidence not reflecting the broader market.

The emotional connection that brands can best be achieved through a blend of digital consumer intelligence methodologies. By combining primary research, social analytics, and quantitative and qualitative analysis, companies can understand their audience comprehensively, enabling them to make well-informed decisions that captivate consumers’ hearts and minds. This harmonious integration of various approaches paves the way for success in the ever-changing world of consumer behavior.

Measuring the Impact of Consumer Intelligence on Brand Performance

As brands strive to forge deeper connections with their audience, understanding the impact of consumer intelligence on brand performance becomes crucial. This understanding can be achieved through key performance indicators (KPIs) and metrics tailored to each type of consumer intelligence methodology, including primary research and social analytics.

With its unique ability to gather firsthand information, primary research can be assessed through metrics such as response rates, data accuracy, and the time it takes to complete the research. By evaluating these factors, companies can determine the effectiveness of their primary research initiatives and optimize their methods better to understand consumer preferences, motivations, and behaviors.

On the other hand, social analytics offers a wealth of digital data that can be evaluated using KPIs such as engagement rates, sentiment analysis, and share of voice. These metrics help brands and PR pros measure their online presence and the success of their social media campaigns, allowing them to adapt their strategies to align with consumer sentiment and trends.

To assess the return on investment (ROI) of consumer intelligence, companies must consider various factors, including the cost of data collection, the insights generated, and the subsequent actions taken based on these insights. By comparing the investment in consumer intelligence initiatives to the resulting growth in revenue, customer satisfaction, or brand reputation, brands can gauge the effectiveness of their strategies and make well-informed decisions.

As AI-enabled consumer intelligence evolves, new reports and tools emerge to help companies make sense of their data. One such resource is Forrester’s New Wave: AI-Powered Consumer Insights report. This report delves into artificial intelligence’s role in extracting valuable insights from consumer data, offering a cutting-edge perspective on consumer intelligence methodologies and their impact on brand performance.

Consumer intelligence is invaluable for brands and PR pros to understand their audience better and make informed decisions. By employing the right KPIs and metrics to evaluate the impact of different methodologies and understanding the ROI of their efforts, companies can navigate the ever-changing landscape of consumer behavior and drive success in a competitive market.

The Forrester New Wave: AI-Powered Consumer Insight Platforms

The Forrester New Wave™: AI-Enabled Consumer Intelligence Platforms Report is a comprehensive analysis of the latest advancements and trends in consumer intelligence. This influential report evaluates the leading platforms that leverage artificial intelligence (AI) to provide in-depth insights into consumer behavior, preferences, and motivations. It serves as a valuable resource for brands and PR pros seeking to harness the power of AI to drive success in today’s competitive market.

The report identifies critical criteria for evaluating the effectiveness and functionality of AI-enabled consumer intelligence platforms, offering an unbiased assessment of their strengths and weaknesses. These criteria include the platforms’ data sources, analytics capabilities, user experience, and overall performance. By examining these factors, the report provides a clear picture of each platform’s ability to deliver actionable insights and drive informed decision-making for companies.

Forrester’s New Wave™ report not only compares the leading platforms in terms of features and capabilities but also provides insights into emerging trends and innovations within the AI-powered consumer intelligence space. This information empowers brands and PR pros to stay ahead of the curve and adopt cutting-edge strategies to forge deeper connections with their audience.

Forrester’s approach to naming the consumer intelligence software category remains ambiguous. While discussions around AI-enabled consumer intelligence began in late 2019, only now has a report published with this precise title. This uncertainty coincides with a flurry of activity in the Forrester Wave over the past year, likely due to the weight assigned to AI adoption and integration within their evaluation framework.

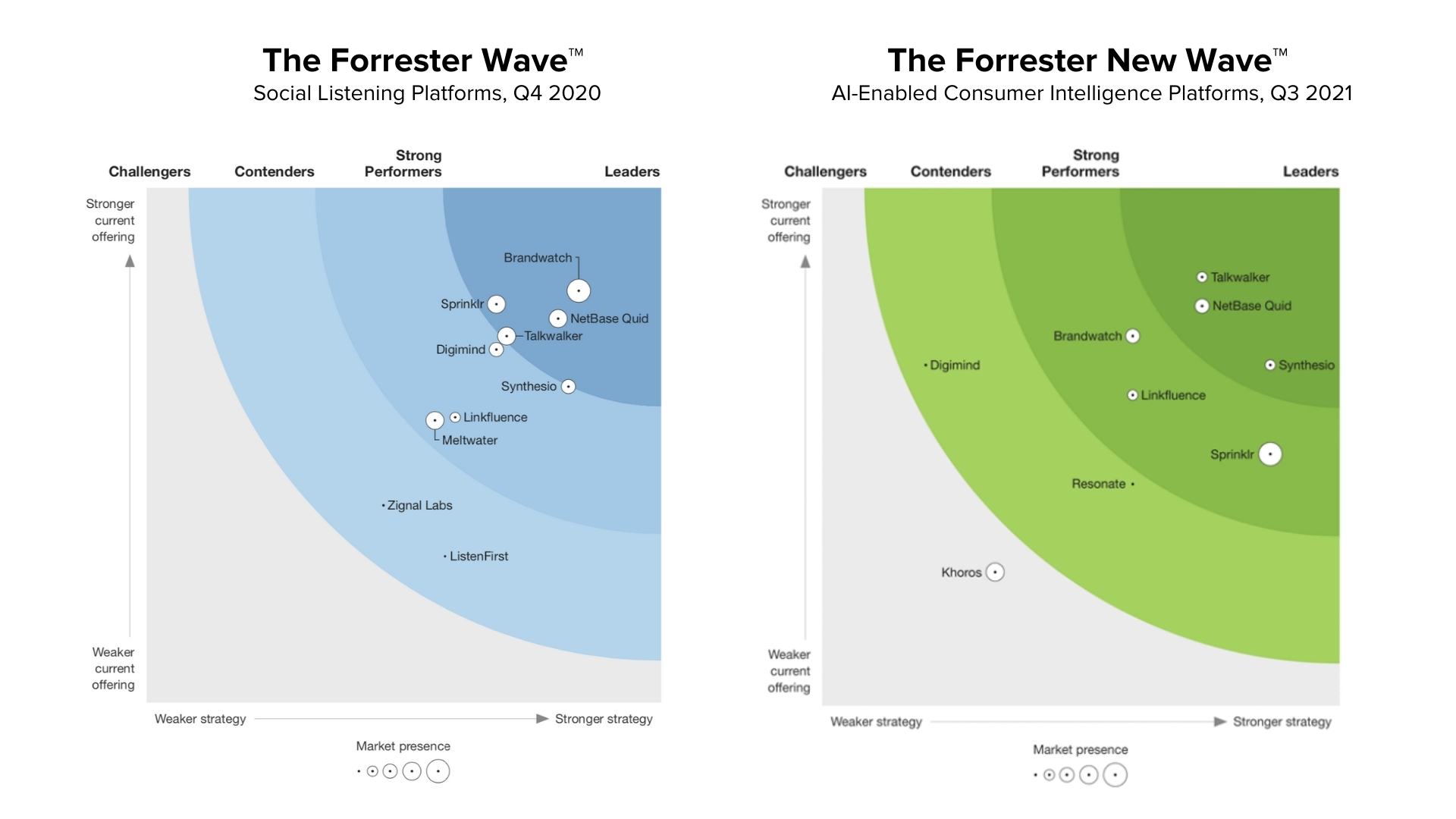

Brandwatch, Talkwalker, Netbase Quid, Synthesio, and Sprinklr emerged as Leaders in the previous year’s report. As illustrated on the diagram’s left side, Talkwalker and Synthesio teetered between Strong Performers and Leaders.

The updated report lists Talkwalker, Netbase Quid, and Synthesio as Leaders. Examining the diagram’s right side, Talkwalker appears to forge ahead of competing digital consumer intelligence platforms. A notable development occurred in October 2021 when they acquired discover.ai, an AI-centric platform merging machine learning with human insight to reveal actionable consumer intelligence.

According to the prior year’s findings, Talkwalker’s present offering outpaces other platforms and ranks among the top three based on current offerings. Synthesio, meanwhile, claims the most comprehensive strategy.

The Forrester New Wave™: AI-Powered Consumer Insight Platforms, Q3 2021

Strong Performers consist of Brandwatch, Linkfluence, and Sprinklr. Regrettably, both Brandwatch and Sprinklr lost their Leader status.

Digimind and Resonate occupy unique positions as sole Contenders. While Digimind dropped a category since the previous year, Resonate made its inaugural appearance in the AI-Powered Consumer Insight Wave.

It is important to note that some vendors from the prior year’s report, such as ListenFirst and Zignal Labs, are absent from the current Forrester New Wave digital consumer intelligence report.

Forrester’s scoring methodology is undeniably transparent; however, the vendor selection process remains nebulous. In addition, a revenue threshold exists for vendor invitations, necessitating the disclosure of revenue data to Forrester—an unwelcome prospect for some consumer intelligence firms.

This could explain why certain vendors may be unable to participate in the assessment, given the rigorous evaluation requirements set forth by Forrester.

Other Consumer Intelligence Software in the Market

I have been tracking the social media monitoring space for the last decade. I wanted to compile a list of vendors I have worked with and provide insights into their capabilities based on my experience. It is not an exhaustive list by any means, but here are a few to consider:

Pulsar Platform: Pulsar has a powerful digital consumer insights offering. They provide cross-channel intelligence for social media and Google searches. They also have powerful visualizations, filtering, and analysis tools built into the platform. Pulsar is excellent for uncovering actionable insights and identifying customer needs, wants, and desires.

Infegy: Infegy is another platform with robust text analytics and natural language processing capabilities. They also build pre-defined audience segments, allowing their clients to layer on demographics, channels, interests, and affinities, making the data extremely valuable. They have recently released an interactive dashboard documenting the best brands on social media. I would classify Infegy more as a market research platform. Their consumer data and text analysis are among the strongest in the market.

Audience Analysis Platforms: I have started compiling a list of software vendors that analyze audiences. This is an area that I am very passionate about because it’s not the same as social listening. Forrester has acknowledged this as a specific category but does not necessarily include it with these more extensive consumer intelligence reports.

While this is still a relatively new software category and an evolution from traditional social listening vendors, they must undoubtedly be a part of your martech stack and larger B2B marketing strategy.

Navigating the Future of Consumer Intelligence in Brand Marketing

As brands dive deeper into consumer intelligence, ethical considerations, and data privacy become paramount. Companies must strike a delicate balance between collecting valuable insights and respecting the privacy of their audience. By adhering to data protection regulations and promoting transparency, brands can foster trust and maintain a strong reputation in the eyes of consumers.

The future of consumer intelligence in brand communications is rife with emerging trends, offering companies innovative ways to understand and connect with their audience. One such trend is the increased use of artificial intelligence (AI) and machine learning to extract valuable insights from vast data. Additionally, the growing importance of personalized experiences and real-time engagement further exemplifies the evolving nature of consumer intelligence.

To thrive in this ever-changing landscape, brands must be agile and adapt to the shifting patterns of consumer behavior. Companies that harness the power of advanced technologies and embrace new methodologies will be better equipped to anticipate and meet the needs of their audience. By doing so, they can create more meaningful connections and drive success in an increasingly competitive market.

Critical takeaways for navigating the future of consumer intelligence software in brand marketing include:

- Prioritizing ethical considerations and data privacy to build trust and maintain a strong reputation.

- Staying informed about upcoming trends, such as AI-powered consumer insights and personalized experiences.

- Adapting to evolving consumer behavior by adopting innovative strategies and leveraging advanced technologies.

The future of digital consumer intelligence in brand marketing is promising. Brands should prioritize ethics and data privacy and stay ahead of emerging trends. Embracing these principles will strengthen their emotional connection with consumers and pave the way for long-lasting success.

FAQ

Q. Why is consumer intelligence important for brand marketing?

A. Consumer intelligence can help brand marketers understand their audiences, leading to personalized marketing campaigns, enhanced customer loyalty, and increased revenue.

Q. How can consumer intelligence be applied to improve marketing strategies?

A. Consumer intelligence helps brands identify trends, preferences, and motivations that drive their target audience.

Q. What are the critical challenges faced when implementing consumer intelligence?

A. Some challenges include maintaining data privacy and ethical considerations, ensuring data accuracy and representativeness, and managing the volume and variety of data.

Q. How do AI-powered consumer insight platforms enhance consumer intelligence?

A. AI-powered consumer insight platforms leverage advanced algorithms, natural language processing, and machine learning techniques to process large volumes of structured and unstructured data. The tech can help uncover hidden patterns and provide actionable insights at scale.

Q. How can companies adapt to the future of consumer intelligence in brand marketing?

A. Brands should stay current with emerging trends, invest in advanced technologies and tools, prioritize data privacy and ethical practices, and foster a culture of innovation and continuous learning.