Key Insights 📈 🌐

- Data-Driven Strategies Always Win: Utilizing media landscape analysis, marketers harness robust, data-driven insights, ensuring that strategies are not merely innovative but are deeply rooted in tangible data and applicable knowledge, providing a competitive edge in the marketplace.

- Multifaceted Focus Enhances Analysis: Tailoring media landscape analysis to various aspects like topics, industries, and generations provides a comprehensive and actionable overview of diverse elements, such as the metaverse and mobile network industry, enabling a nuanced approach to strategy development.

- Media Landscape Analysis is Indispensable: A meticulous traditional media landscape analysis reveals pivotal information about top media outlets, core narratives, and influential journalists, which can be segmented and scrutinized in diverse ways to formulate a triumphant media strategy.

- Audience Insights are Crucial for Engagement: Delving into audience insights reveals the customer journey, conversation themes, and preferred social media channels. This enables marketers to craft strategies that meet the audience with resonant content and engage them effectively on their preferred platforms.

- Identifying Influencers is Obvious, But Often Overlooked: Recognizing and understanding the dynamics of top-performing creators and influencers within a market and insights into their communities and influence on consumers is vital in shaping a brand’s influencer marketing and partnership strategies.

- Cultural Context Must Drive The Analysis: Acknowledging and integrating cultural context, which encompasses norms, beliefs, and trends within society, is imperative in developing messages and campaigns that are culturally pertinent and resonate authentically with the target audience.

- Understanding the Social Media Landscape is Critical: Grasping the entirety of the social media landscape, which includes major and emerging platforms, is crucial for a broad view of the digital communities where audiences engage, ensuring that strategies are relevant across diverse digital spaces.

A media landscape analysis can provide the insights you need to launch high-impact marketing campaigns and dominate your job at the same time.

Why this matters:

Two reasons. The insights from a landscape analysis ensure that data inform your marketing strategy. And we live in a highly competitive world. The more data and industry knowledge you have, the more success you will find in your role.

What is a Media Landscape Analysis?

A landscape analysis is multifaceted and complex. Hundreds of industries, verticals, and categories come into play. But at the end of the day, an industry analysis will provide insights to help you execute your marketing strategy with precision and focus, producing results that exceed expectations.

A media landscape can be a topic, industry, generation, competitive, or all four. For example, suppose you work for a mobile phone provider like Verizon (or a similar organization). In that case, you’ll want to know everything about the mobile network industry, NFTs, Web 3.0, and the metaverse.

Utilize a media landscape analysis to extract robust, data-driven insights for a competitive edge in the marketplace. It’s relevant for all brands, key markets and trending topics.

And perhaps you have two core audiences you are trying to reach in 2023–Gen Z and Millennials. A media landscape analysis will give you actionable insights into the topic of the metaverse, the mobile network industry, and everything you want to know about each audience, including Gen Z media consumption, trends, and basic demographics.

You can expect to get details and insights about the following.

Traditional Media Landscape Analysis: Dissecting The News

A thorough market landscape analysis will provide you with three important pieces of information that will help ensure the successful starting point of your media strategy.

- An analysis of the top media outlets driving the most impactful coverage of your research topic.

- An analysis of the core narratives driving the coverage in the top media outlets.

- An analysis of the journalists and their level of influence when they write about such topics.

Depending on time, budget, and resources, you can get much more granular with this analysis. For example, you can segment the media by industry (e.g., B2B/tech, consumer lifestyle media), do two separate analyses, and then compare the results. Or, if you already have a media list, you can run your analysis against that data set. You can filter for brand coverage and then layer on sentiment and impact across each media segment.

Audiences & Their Behavior In The Social Media Landscape

The social media landscape offers rich opportunities to understand audience behavior, interests, and needs. By analyzing data across platforms, brands can gain valuable customer insights:

| Area | Description |

|---|---|

| Audience personas | Create detailed profiles of customer segments based on demographics, psychographics, interests, and social media usage |

| Customer journeys | Map typical path from awareness to purchase; highlights touchpoints to engage users |

| Conversation themes | Identify trending topics, questions, and concerns your audiences discuss online |

| Platform preferences | Determine which social platforms different audience segments are most active on |

| Influential outlets | Discover media sites, blogs, influencers that resonate most with target users |

| Content performance | Analyze engagement on different content types; inform future content strategy |

Audience Personas

Creating detailed buyer personas based on social media usage enables more personalized outreach. Look at demographic and psychographic data like age, location, gender, income level, interests, values, and personalities of key customer groups. Combine this with analytics on the social platforms and content they engage with. Develop profiles summarizing statistical data and giving the persona a name, photo, and bio. Fully defined personas keep messaging tailored to what will resonate.

Mine data to reveal audience journeys, conversation themes, and preferred social channels for resonance. Know your customer for meaningful engagement.

For a travel brand, build a persona like “Explorer Evie,” a 28-year-old in NYC passionate about adventure travel. Pull social data on young professionals interested in hiking and backpacking to capture relevant details. Bring Evie to life with a photo and bio highlighting her camping experience.

Customer Journeys

Map out the typical journey your audience members take from initial awareness of your brand through consideration and purchase. Look for patterns in the stages and timeframes. Identify what social content and activities influence their progress through the funnel. This highlights opportunities to engage users at different points in their journey. Create customized calls-to-action and social content appropriate for each stage.

For an apparel e-commerce site, the journey may start with an Instagram post, move to following and exploring products on the website, adding items to the cart, and being prompted to complete the purchase through retargeting ads. Offer free shipping at the consideration stage to nudge purchases.

Conversation Themes

Use social listening tools to identify trending topics of conversation, common questions, and pain points your audiences vocalize online around your product category or brand. Join these discussions by providing solutions, insights, and resources. This real-time understanding of customer interests enables PR teams to ideate topical content that adds value. Promote helpful content directly to relevant online conversations.

For a cleaning product company, conversations questioning appropriate disinfecting methods during flu season present an opportunity to share a video on effective cleaning tips. Respond to questions and promote the content in relevant social discussions.

Platform Preferences

Analyze which social platforms and specific audience groups are most active by looking at metrics like monthly active users and engagement rates per platform. For example, LinkedIn may over-index for B2B, while TikTok skews younger. This lets you focus your social media efforts on the channels you can best reach and resonate with your target users. Adapt platform strategies based on preferences.

For a financial services firm, older demographics may be active on Facebook, while millennials are on Instagram and Twitter. Create Instagram stories and Twitter threads with bite-sized financial tips targeting that under-35 audience.

Influential Media Outlets

Use tools like BuzzSumo to determine which media sites, blogs, and influencers your target audiences engage with most. Getting coverage or sponsoring content with popular outlets for your niche helps increase brand awareness and affinity. Prioritize pitching writers and influencers your personas actively follow and respond to.

Meticulously analyze leading media outlets, narratives, and influential journalists to understand the traditional media ecosystem. Assess coverage angles and opportunities.

Food bloggers like Sally’s Baking Addiction drive engagement for a cookware manufacturer. Partner on sponsored recipes and product giveaways, and ensure Sally’s content and channels are on the PR media and influencer list.

Content Performance

Review engagement metrics on social posts across different content formats like video, audio, images, or live broadcasts. Look at engagement by topic as well. This analysis highlights the specific types of content and subject matter that generate maximum interest and engagement. It provides learnings to inform content creation and social media strategies moving forward.

For a software company, create content like new feature announcements, tutorial videos, CEO vlogs, and platform update posts. Compare views and engagement across post types to optimize formats.

Which Influencers Have Topical Authority?

In economics, a market is where buyers, sellers, and thought leaders facilitate the exchange of goods, services, ideas, innovation, and information. Thousands of markets exist today–grocery, diaper, software, mobile networks, and more. There are even more mico-markets within each market, which are always shifting.

Every market can be divided into three separate segments-creators, community, and consumers. Creators account for 1% of the market, the community accounts for 9%, and general consumers account for the rest, 90%.

Creators

This elite 1% of the market wields specialized skills and talent to craft compelling digital content across formats like text, video, and imagery. For instance, popular YouTubers often exhibit innate charisma on camera and savvy editing chops. They follow trends yet also pioneer innovations that set them in motion. Multi-channel influence enables their audience to follow them fluidly across platforms as they expand beyond a single niche. When these creators share new videos or posts, their content frequently goes viral, disseminated widely by dedicated followers.

Recognize top creators and influencers within a niche to inform partnership strategies. Leverage their sway rather than reinvent the wheel.

Vlogger Emily Compagno’s loyal fanbase circulates her fashion hauls and beauty tutorials across Instagram, Facebook, and TikTok. The seamless style and production value keep engagement high across channels. Her strong aesthetics and upbeat personality drive recommendations and sharing among consumers eager for Emily’s next video.

Community Members

This engaged segment, approximately 9% of the overall market, plays an active role in digital communities like subreddit forums, Discord servers, and Facebook groups. Community members adopt roles like moderators, trendpotters, and content curators.

For example, moderators on the r/HealthyFood subreddit shape conversations by drafting rules, monitoring discussions, and amplifying nutritious recipes. Active participants make recommendations and provide feedback within their niche communities. While less viral than top creators, community members influence their specific groups significantly.

Consumers

Comprising the % of any market at 90%, general consumers eagerly consume digital content while creating little of their own. They represent the critical target audience creators, and community members who vie for attention. Consumers research products through searches, read news and reviews, and participate occasionally via likes or comments.

Their preferences and behaviors heavily reflect creators’ influence and the engaged communities they follow. Marketers must analyze this majority segment to understand digital footprints and craft messages that resonate. While not active content producers themselves, consumers’ aggregated online activity and purchasing power impact trends.

A media landscape analysis will uncover the top-performing creators in that market, insights into the community, and their influence on general consumers. A model like this is more relevant to identifying and segmenting B2B creators, as it considers more than just content creation.

Social Media Landscape Best Practices & Use Cases

The social media landscape encompasses the vast and ever-evolving ecosystem of social platforms, communities, and messaging apps that enable people to connect, create, and share online. Key elements of today’s social landscape include:

Platform Type | Examples | Description |

|---|---|---|

| Social Networks | Facebook, Instagram, LinkedIn | Exchange ideas, questions, and recommendations via threaded conversations |

| Media Sharing Networks | YouTube, TikTok, Spotify, Pinterest | Focused on consuming, curating, and creating specific media content |

| Discussion Forums | Reddit, Quora | Exchange ideas, questions, recommendations via threaded conversations |

| Messaging Apps | WhatsApp, Facebook Messenger, WeChat | Facilitate direct communication and information sharing |

| Live-Streaming Apps | Twitch, Live.ly | Broadcast livestreams of gaming, events, and more to engaged audiences |

| Interest-Based Communities | Strava, NextDoor | Share niche content and engage people with shared interests or identities |

| Emerging Platforms | BeReal, Clubhouse, Mastodon | Introduce new models of connecting and engaging |

Social media continues to expand as people find new ways to stay connected, express themselves, and consume content online, and there is so much data available.

Underlying Cultural Context Across All The Data

Cultural context encompasses the shared social norms, beliefs, values, customs, and trends that shape a society. It provides the underlying framework for how people within a culture behave, communicate, and interpret the world around them.

Examining cultural context reveals the unspoken rules and patterns that influence human interactions. This includes aspects like:

- Communication styles – How directly or indirectly people communicate, greetings, concept of time, personal space.

- Values and beliefs – What a society views as good or bad, right or wrong, important or unimportant. Values shape priorities.

- Gender roles – Accepted behaviors and responsibilities based on gender.

- Social etiquette – Customs for polite behavior in social settings.

- Aesthetics – What is considered beautiful, stylish, or visually appealing?

- Humor – What people find funny or humorous based on cultural references.

- Traditions and rituals – Celebrations, ceremonies, or customs with cultural meaning.

- Perceptions – How people understand and interpret the world around them.

- Language – Vocabulary, tone, cadence, idioms, and meaning within a language.

- Relationships – How people interact with others based on social organization and hierarchies.

- Concepts of self – How individuals define themselves within social groups.

Understanding cultural context is crucial for meaningful cross-cultural marketing, communications, business interactions, and design. It enables making appropriate adaptations to resonate with the target audience based on their cultural perspectives, values, and norms.

Landscape Analysis Example: Exploring the Metaverse

Now, let’s jump into a media landscape example.

Below is an example of a metaverse industry analysis. Some of this data has been taken from other research reports I have worked on, so it’s not 100% up-to-date. Most of this data is from early 2022. The purpose is to show you examples of deliverables you should receive after completing a brand analysis.

Media Coverage & Landscape Analysis

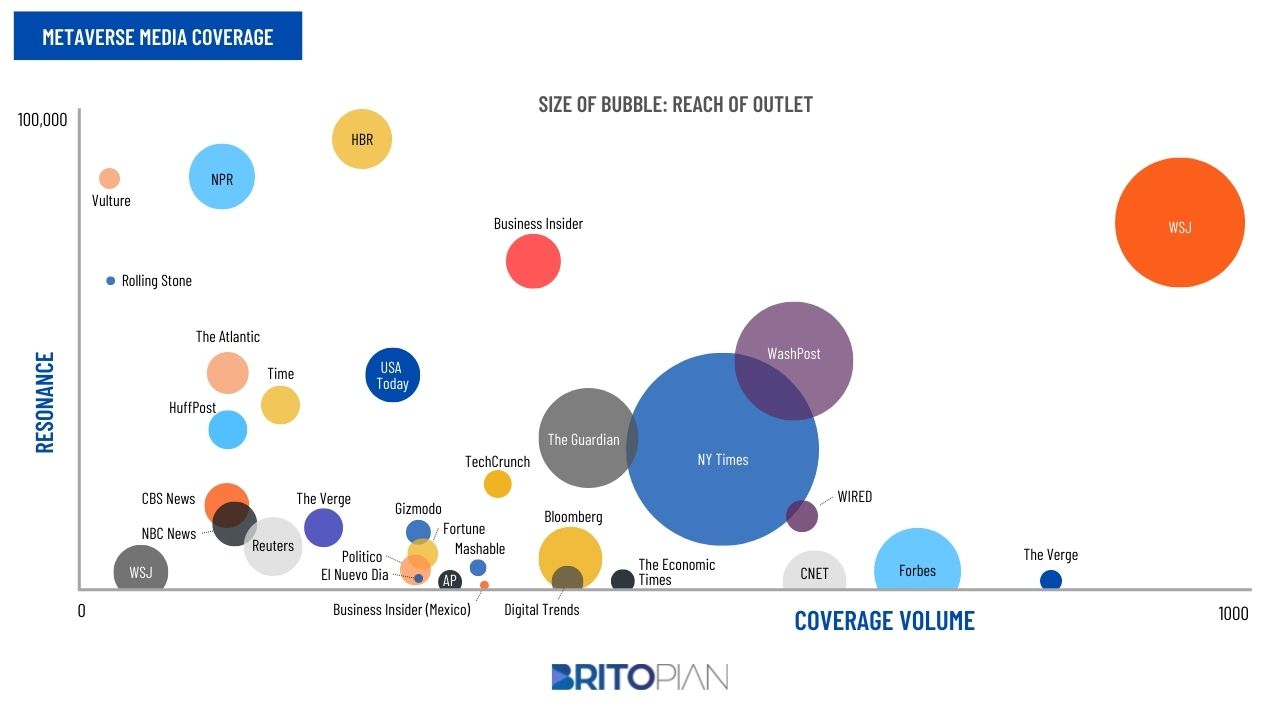

The metaverse media coverage shows the impact of each media outlet plotted. There are three data points to understand.

- The X-axis represents the total volume of coverage of the metaverse.

- The Y axis represents total engagement from the coverage.

- The size of the bubble represents the total reach of the media outlet.

So, regarding metaverse coverage only, the Wall Street Journal has written nearly 1,000 articles about the topic over this period. That coverage has resulted in almost 100,000 total engagements. And when you compare the bubble size with the other media outlets on that graph, they are the second largest, right behind the New York Times. The data is based on the website’s total unique visitors per month.

On the other hand, Harvard Business Review has a lower volume than the New York Times, but when they write about the metaverse, they generate much more engagement with their content.

Narrative Landscape Analysis

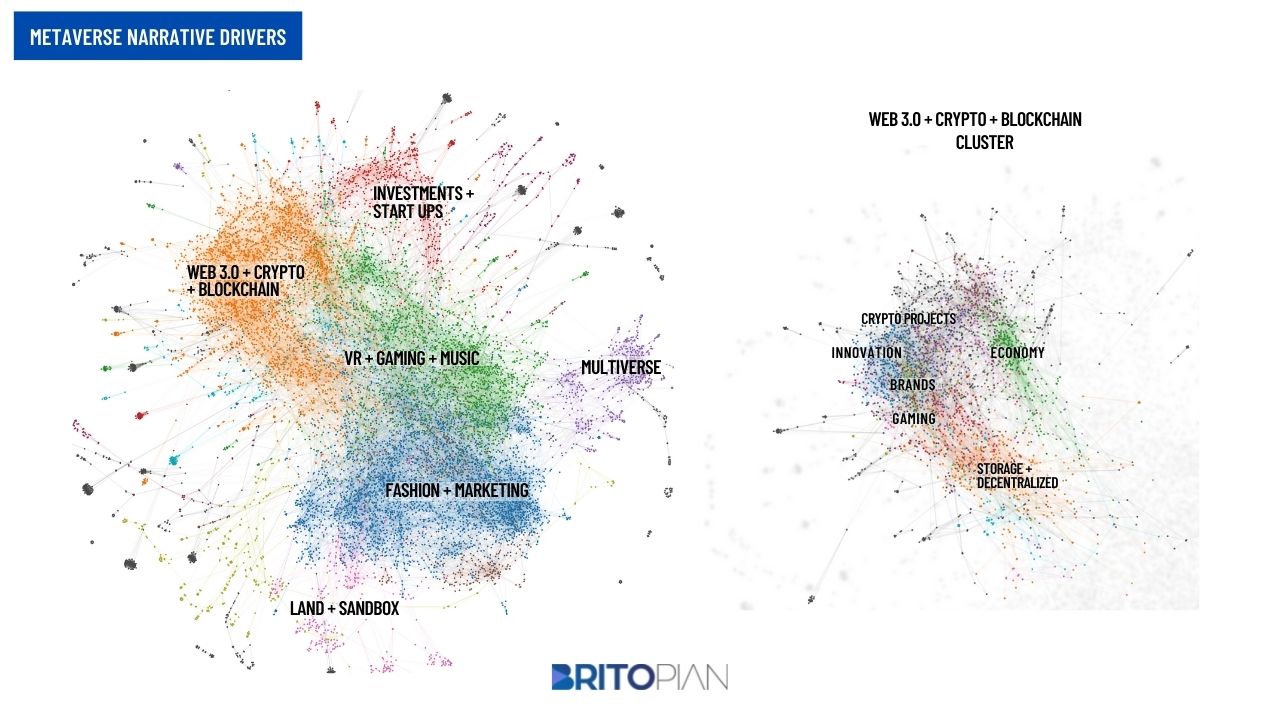

Now that we have identified the top media outlets writing about the metaverse, it’s important to dissect the topics within that context and answer the following question:

What about the metaverse is so important?

A narrative analysis uses text analytics to discover the topics, themes, and narratives discussed around the metaverse. This will tell us what matters to the media and why it resonates with them. This is also referred to as content marketing analysis, but more advanced.

And see from the data on the left, six core narratives stand out within the coverage.

- Investments & Start-Ups

- Web 3.0 + Crypto + Blockchain

- VR + Gaming + Music

- Multiverse

- Fashion + Marketing

- Land + Sandbox

It would be impossible to uncover these narratives by reviewing a spreadsheet with all the coverage or using a media monitoring platform. This approach uses NLP to categorize the coverage based on what’s being written about in the full text of the article.

However, the analysis on the right is a double-click into the “Web 3.0 + Crypto + Blockchain” cluster. This will tell what’s being covered about this sub-topic in more detail. The more you drill down into the data, the more insights you will get.

This should give you an idea of how you might want to prioritize your PR strategy.

Metaverse Audience Segments

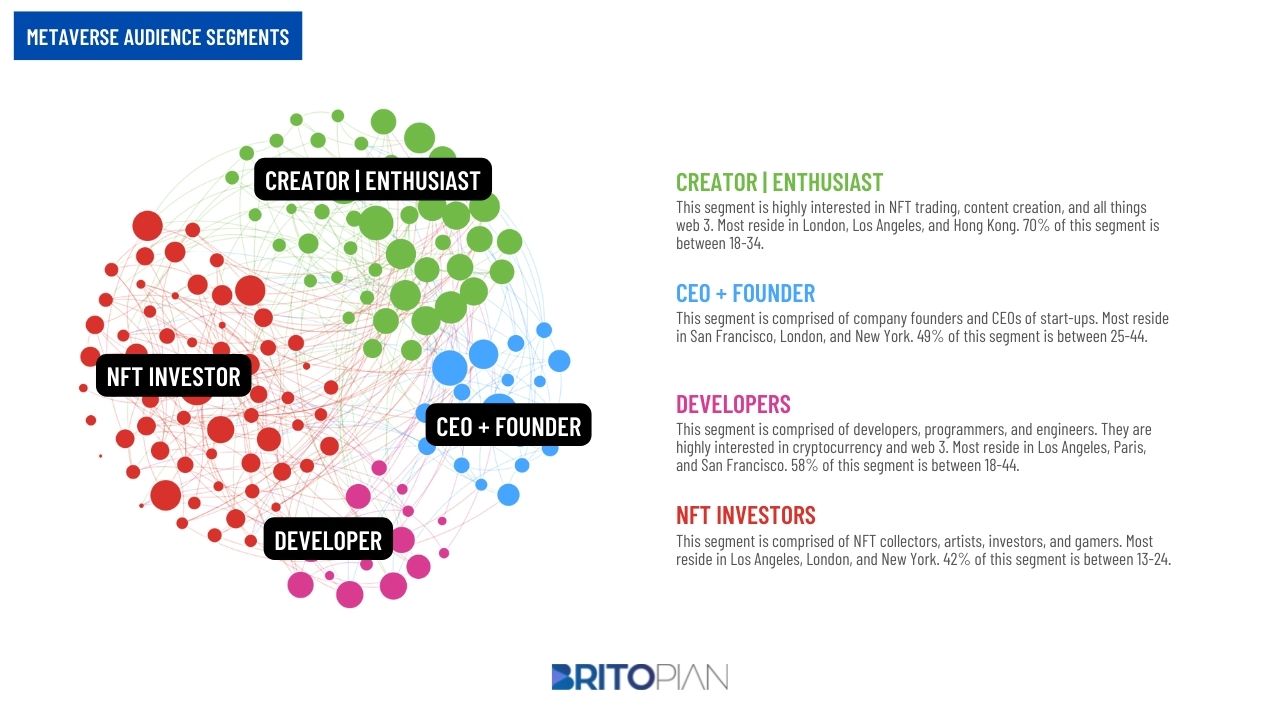

A media landscape analysis would not be complete without building an audience to understand who they are, what they care about, how they identify themselves, and their affinities related to the content they consume.

The below data shows the audience talking the most about metaverse across the social media ecosystem. It’s segmented into four different audiences, a smart approach that can give you more information about whom you are trying to reach.

However, audience segmentation becomes more valuable when you analyze each one individually to see how they are interconnected, similar, and different, as well as any unique differences between them.

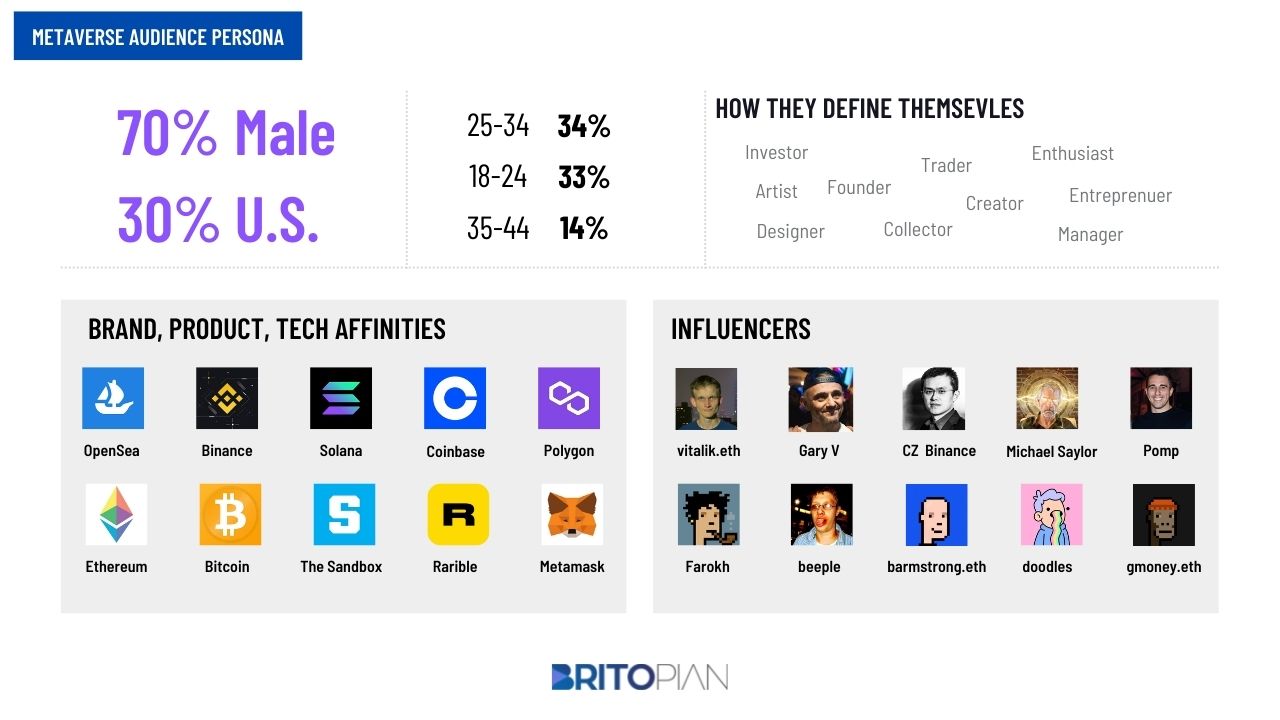

The below metaverse audience persona is an overview of all the combined segments mentioned above. This is not a best practice, but it’ll do for the sake of this post. Remember, the more you can segment data, the better insights you will have, as previously mentioned.

I wrote a lengthy post about audience personas and provided several examples and types you can build.

The data shows basic demographics, how they define themselves in their bios, some brands and products they have high affinities for, and who influences them online. It’s not uncommon to do a conversation analysis of the audience based on the topic at hand. At times, it’s good to compare how the media writes about the metaverse versus how the audience talks about it. Here’s a scrappy text analysis of the metaverse community to use as a reference point

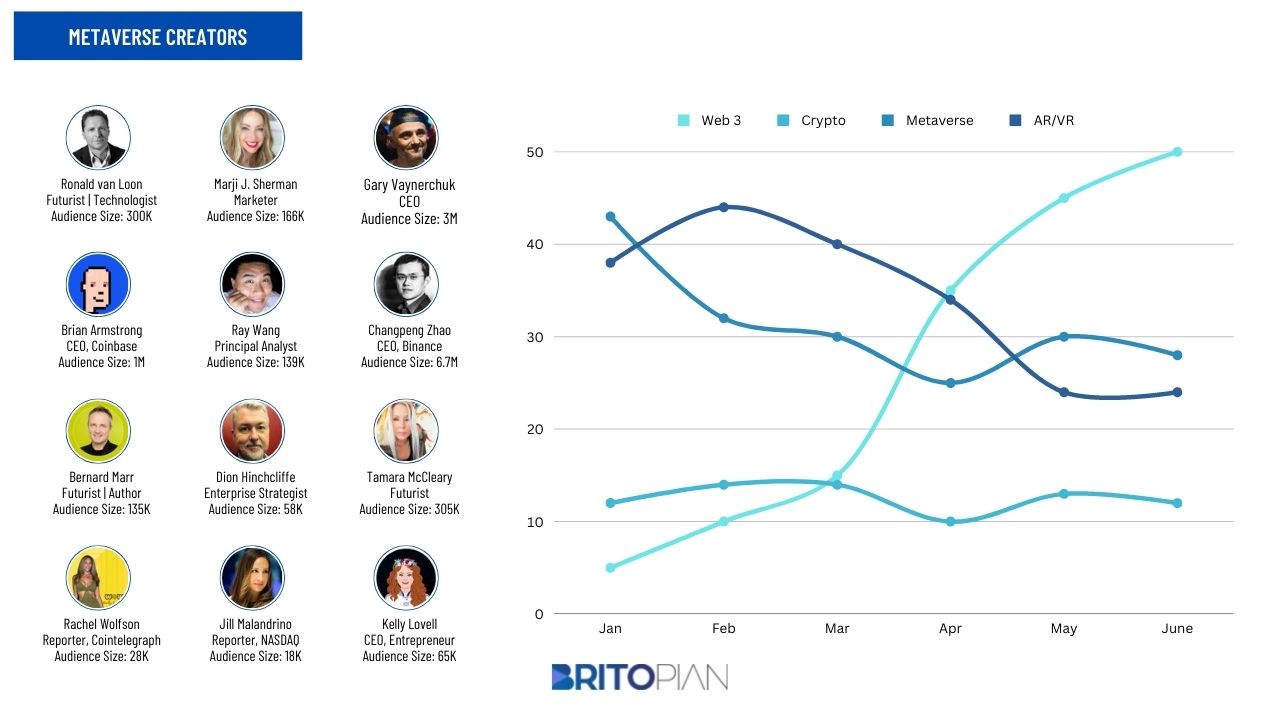

Metaverse Creators & Influencers

There are several ways to identify creators and influencers. One way is through a media landscape analysis like this one.

Another way is to start with audience analysis, like above. The data will uncover who influences the audience based on an affinity analysis. An affinity analysis will uncover the percentage of an audience that follows or engages with the influencer. I like to use a combination of both approaches when identifying a creator or influencer. It depends on the topic, vertical, and industry.

The trend graph above, next to the influencer profiles, tracks the number of mentions of each topic from January through June. You can think of this as social listening for the creator community. It tells you that topics like Web3 are increasing in popularity, and AR/VR are decreasing in popularity. A more advanced approach would include a text-based analysis, providing the context of those topics and themes and a deep dive into the voice of the customer.

Cultural Context

The cultural context will come from large research studies commissioned by global companies like Global Web Index, Insider Intelligence, Kantar, Morning Consult, and Resonate. Advisory firms like Deloitte, Accenture, and KPMG also publish reports.

Below is an example of a report published by Deloitte, “Future is here Global XR industry Insight,” and Global Web Index’s “Making Virtual a Reality: How Brands Can Win in Web3” report.

Social Media Landscape Analysis

A robust understanding of the social media landscape provides an invaluable cultural context for communications and marketing initiatives. Annual reports from research firms like Global Web Index offer comprehensive data on evolving usage habits and trends across social platforms.

For instance, their 2022 report reveals key patterns like the rise of TikTok among Gen Z users, expanded functionality driving Instagram Reels adoption, and a usage plateau on mature platforms like Facebook. Global Web Index surveys internet users worldwide to quantify changes in social media attitudes and behaviors over time.

Resources like Statista also aggregate data on audience demographics and growth across leading networks. Their visualization tools and downloadable reports drill down on platform-specific statistics that can inform channel selection and targeting. While paid subscriptions provide more complete data, Statista’s free access still offers solid baseline numbers to guide social strategy.

Competitive Landscape Analysis

While not universally required, incorporating a competitive analysis into market research provides helpful context on where your brand stacks up against others vying for consumer attention and loyalty.

This allows examining how media coverage, influencers, and target audiences perceive your company compared to dominant players or disruptive startups within your niche. Are competitors viewed as innovative or trustworthy? What are their perceived strengths and weaknesses? What partnerships or strategies set them apart?

A competitive landscape analysis should review brand websites, social media, thought leadership content, and press mentions. Third-party data on market share, customer satisfaction, and growth help paint a fuller picture. These insights help position your brand favorably amid the current landscape while anticipating what’s ahead.

Landscape Analysis Final Thoughts

A comprehensive media landscape analysis represents an invaluable asset for today’s marketers, arming them with multifaceted data-driven insights integral for crafting resonant campaigns. By examining facets ranging from industry trends to audience behaviors and cultural contexts, these insights equip teams to build marketing strategies with surgical precision.

Rather than taking a generalized approach, marketers can penetrate specific niches by leveraging key findings from the media analysis. For example, they can identify and partner with the top influencers who hold sway among their target demographic based on engagement metrics and readership profiles. Just as crucial, they gain perspective on the cultural attitudes, conversations, and concerns circulating among their audience to inform messaging nuances.

Ongoing monitoring of the traditional and social media landscape allows brands to identify emerging trends, platforms, and voices to remain agile. As consumer attention fragments across digital channels, the ability to engage audiences through preferred outlets and community spaces becomes increasingly vital. Media analysis supports dynamic channel selection and content formats tailored to data-driven audience preferences.

Informed strategy trumps guesswork. With infinitely expanding information, the organizations able to synthesize this data into meaningful guidance are poised for impact. Rather than defaulting to the safety of following existing trends, analytics-driven strategies empower marketers to make decisive, calculated moves.

Success stems from campaign messages and brand interactions that resonate deeper because they are forged from a 360-degree understanding of the consumer and the playing field. These insights allow beyond surface-level demographic targeting to build connections rooted in cultural awareness and empathy.

The nuanced approach to media analysis enables moves beyond generalized mass marketing to precision messaging crafted for a clearly defined audience. While aiming for campaign sophistication, marketers must also infuse creativity and emotion to spark meaningful engagement. Data-informed human-centric storytelling.

Even the most creative marketing risks missing the mark without an evidence-based foundation. Media analysis removes the need for guesswork and provides actionable direction to inform strategic and tactical decisions. For organizations looking to sharpen campaign effectiveness and exceed objectives, a comprehensive examination of the current media landscape is no longer optional – it is fundamental.

Alright, strap in. If you’re thumbing through the pages of a media landscape analysis like it’s some dusty old novel, you’re missing the plot. This isn’t about reading; it’s about doing. The one golden nugget you need to understand? Knowing your audience is no longer just about demographics and favorite ice cream flavors. It’s diving headfirst into the deep end of their digital world, understanding every like, tweet, and TikTok dance they’re obsessed with. Suppose you’re not using media landscape analysis to craft a strategy that’s as personalized as their Spotify Wrapped. In that case, you’re basically that one person at the party who still thinks talking about the weather is engaging. Newsflash: It’s not.

FAQ

The media landscape refers to the dynamic environment of media outlets, content, platforms, and the cultural context in which media is produced and consumed. It can encompass a variety of topics, industries, generations, and competitive elements.

A landscape analysis thoroughly examines media outlets, narratives, audience behaviors, and influencers within a specific industry or topic. It provides insights into customer journeys, conversation themes, platform preferences, and content performance.

Components of a landscape analysis typically include traditional media landscape dissection, audience and behavior analysis in social media, identification of influential media outlets and creators, and an understanding of the cultural context across all data.

Media analysis is the process of examining the various aspects of the media landscape to gather actionable insights. It involves dissecting news coverage, analyzing audience behaviors, identifying key influencers, and understanding the cultural context of media consumption.

A media landscape analysis benefits marketers by providing robust, data-driven insights that inform strategies, ensuring they are relevant and competitive in the marketplace.

Understanding traditional media is crucial as it reveals pivotal information about top media outlets, core narratives, and influential journalists, which are essential for formulating a successful media strategy.

Audience insight is critical because it reveals the customer journey, conversation themes, and preferred social media channels, enabling marketers to engage effectively with resonant content on the right platforms.

Identifying influencers is key to shaping a brand’s influencer marketing and partnership strategies, as it provides insights into the dynamics of top-performing creators and their influence on consumers.

Cultural context is imperative for developing messages and campaigns that are culturally pertinent and resonate authentically with the target audience, as it encompasses societal norms, beliefs, and trends.

Understanding the social media landscape is critical for a broad view of the digital communities where audiences engage, ensuring that strategies are relevant across diverse digital spaces.